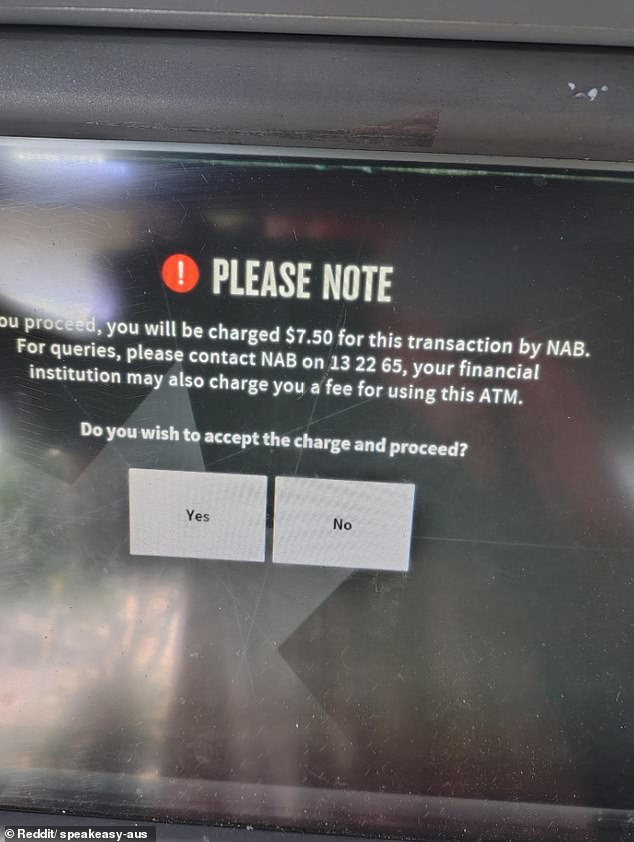

Imagine going to grab some cash and being hit with a whopping $7.50 fee! That’s exactly what happened to one stunned Aussie at a NAB ATM in Townsville. Talk about a nasty surprise!

What Actually Happened?

A Ubank customer was trying to withdraw $100 when they spotted the shocking fee message. That’s a massive 7.5% charge just to access their own money! Naturally, they said “no thanks” and found a cheaper option nearby.

NAB’s Response: “This Shouldn’t Have Happened”

NAB quickly jumped in to clear things up. Their spokesperson told Yahoo Finance this was definitely not normal. “Neither NAB nor Ubank charge fees for these transactions,” they said. The bank’s now fixing the glitchy ATM and promised to refund any fees.

What’s Normal for ATM Fees in Australia?

Here’s what you should know:

- The big four banks ditched ATM fees years ago for Aussie debit cards

- This applies even if you’re using another bank’s ATM

- Credit cards and foreign cards might still cost you though

Fun Fact: ATMs Are Disappearing!

Did you know we’re seeing fewer ATMs around? Last year alone, 217 machines were removed across Australia. In the last five years? A whopping 6,000 have disappeared!

Traveling Abroad? Watch Out for This Money Trap!

If you’re heading overseas, here’s a pro tip: When withdrawing cash abroad, always choose to pay in the local currency, not Australian dollars. Why? The local conversion usually gives you a better deal than the ATM’s own conversion rate.

The Real Cost of International Transactions

Get this – Aussies lost about $600 million to international transaction fees last year alone. That’s roughly $92.62 per person!

Want to save money? Do your homework before traveling and check your bank’s international fees. Your wallet will thank you later!