Australian Property Market Facing $611 Billion Hit Due to Climate Change – What It Means for Your Home and Family

-

- Stunning new climate risk assessment warns property values could plummet by $611 billion by 2050 under a 3°C warming scenario

- Insurance premiums could rise by up to 10% in high-risk areas, making homes unaffordable for many Australians

Australia’s property market is staring down the barrel of a $611 billion hit due to climate change, with dire warnings that property values could plummet by 2050 under a 3°C warming scenario.

The stunning assessment, released yesterday, paints a grim picture of a country grappling with the devastating impacts of rising temperatures.

Ehsan Noroozinejad, Senior Researcher and Sustainable Future Lead at Western Sydney University’s Urban Transformations Research Centre, warned that the figure isn’t just a bill to repair or rebuild homes after disasters, but a drop in market value as climate risk becomes clearer.

“If a house that might have sold for $800,000 without these risks sells for $720,000 once flood risk and higher premiums are factored in, that $80,000 difference is a ‘loss in value’,” he explained.

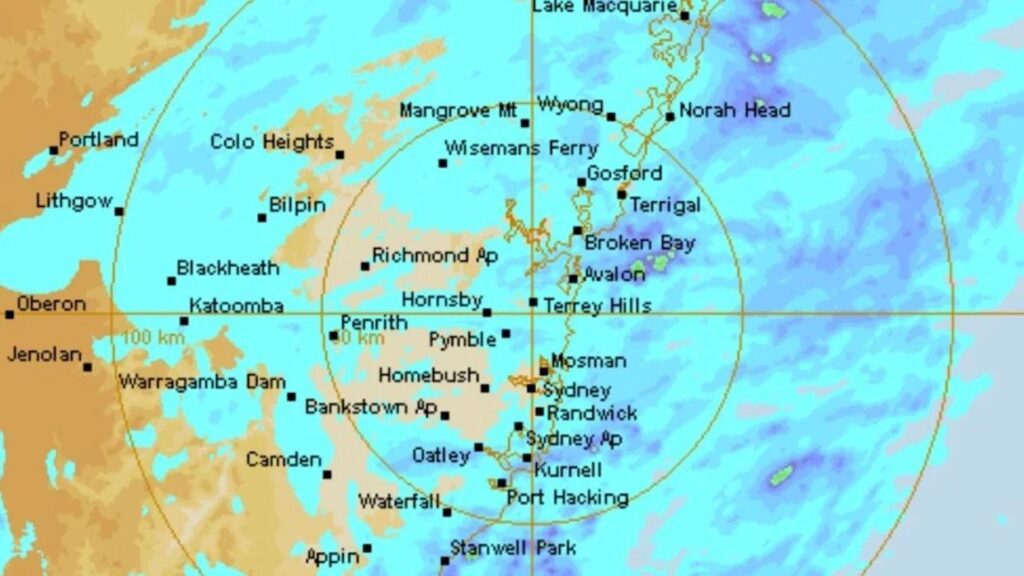

“It’s not just beachfront homes that are at risk; even low-lying areas within 10 kilometres of soft shorelines could be in high and very high risk areas for coastal flooding and erosion by 2050,” warned Dr. Noroozinejad.

The assessment predicts that 1.5 million people in coastal communities could be in high and very high risk areas for coastal flooding and erosion by 2050, with the number potentially growing to a third of coastal communities – home to more than 3 million people – by 2090 if populations stay put.

“Governments, communities, and households can all do more in response to these two new reports,” urged Dr. Noroozinejad. Four key gaps that need to be addressed include national floodplain mapping with consistent data, open-access extreme weather-water models, continuous monitoring and event forensics, and regional ‘testbeds’ linking researchers, councils, and insurers.