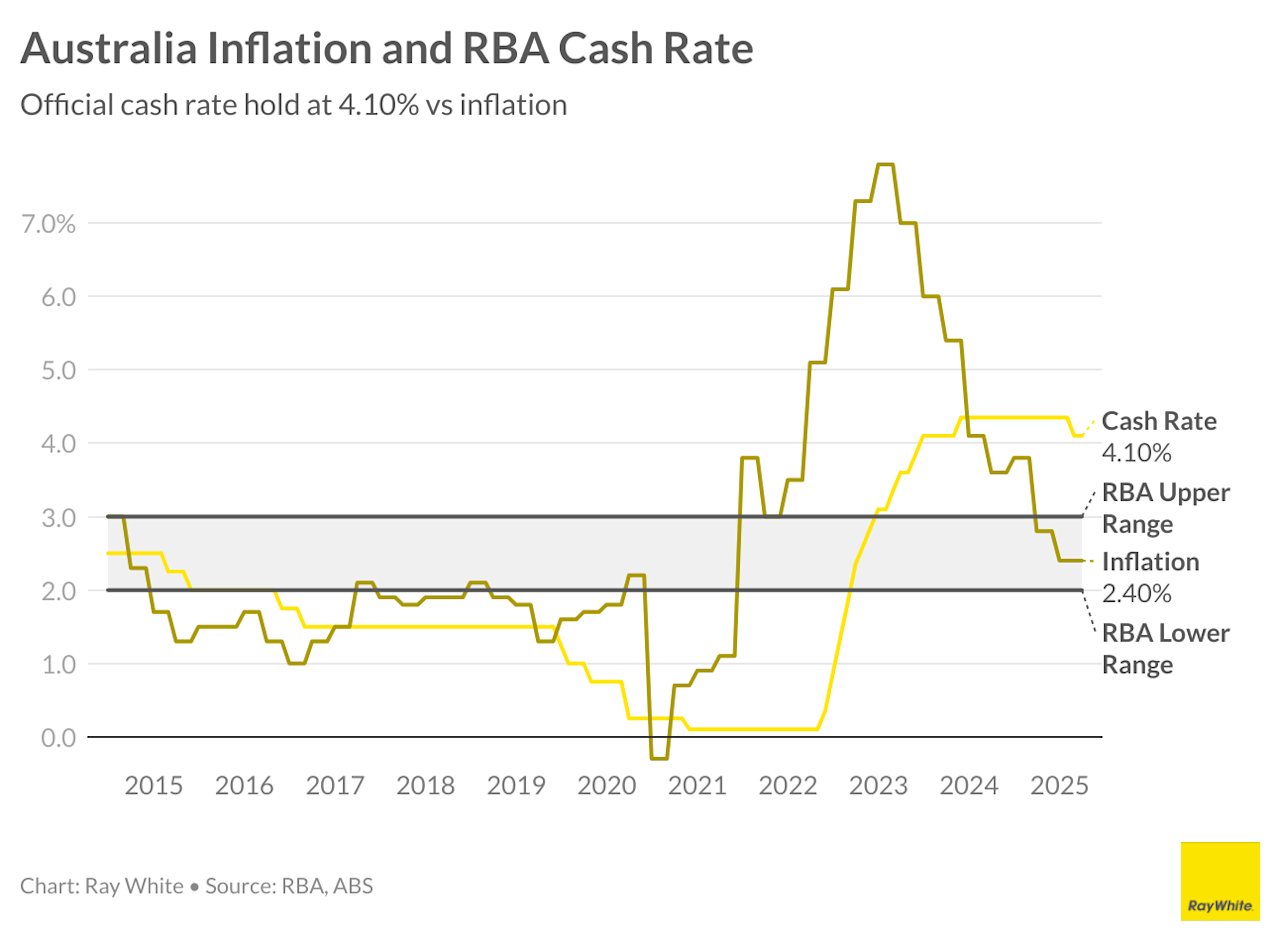

Reserve Bank Expected to Cut Interest Rates Amid Lingering Inflation Concerns

The Reserve Bank of Australia is poised to announce a highly anticipated interest rate cut today, with economists forecasting a 25 basis point reduction to bring the official cash rate down to 3.60 per cent.

This move is expected to provide relief to mortgage holders, with a homeowner with a $500,000 mortgage set to save approximately $2884 per year.

The central bank’s decision comes on the heels of new data showing inflation has dropped to 2.1 per cent, its lowest level in four years, and within the Reserve Bank’s target range of 2-3 per cent.

A softening labour market has also contributed to expectations of a rate cut.

Inflation Remains a Concern Despite Falling Rate

While the Reserve Bank is likely to cut interest rates, new research reveals that everyday costs remain high for Australians, who continue to feel the squeeze.

An investigation found that households are reducing their spending on discretionary items such as coffee, entertainment, and holiday travel.

The market is also pricing in a roughly fifty-fifty chance of a larger, 50-basis-point cut, which would bring the official cash rate down to 3.35 per cent.

However, the ongoing impact of inflation on household expenditure is likely to remain a key consideration for policymakers.

Stay tuned for further updates as the Reserve Bank announces its interest rate decision at 2:30pm (AEST) today.