A young property investor has hit back against claims he’s fuelling Australia’s rental crisis by snapping up homes.

Rents have been rising in nearly every capital city across the country and it’s creating stress for many.

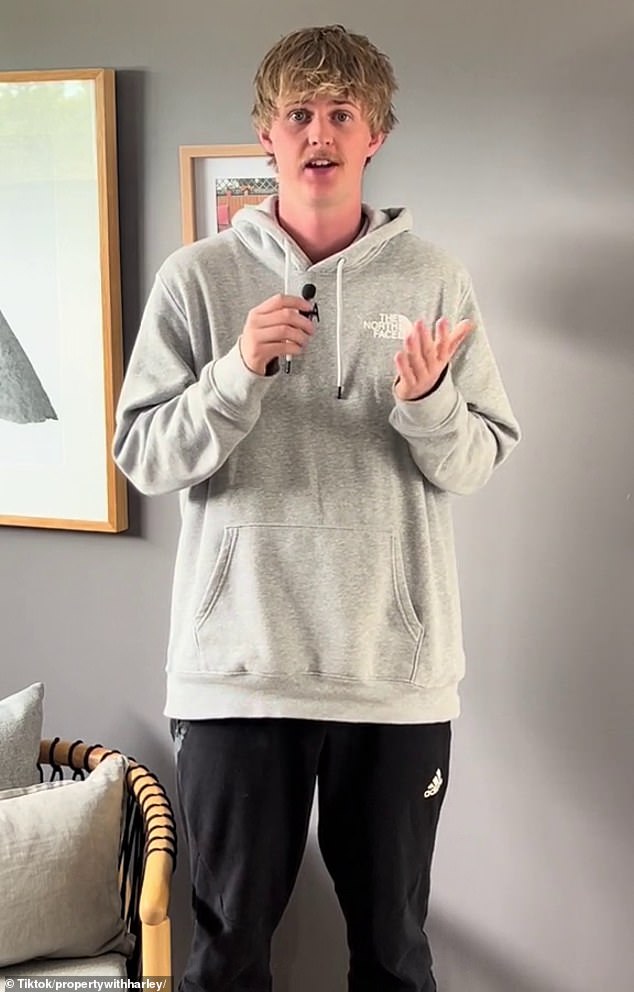

Harley Giddings has worked hard since he was a teenager and has managed to amass an impressive property portfolio for a 24-year-old.

But he said he’s copped negativity from Aussies who claim he’s making the rental situation worse.

“I definitely do understand there is a bit of hurt at the moment with the cost of living and rents increasing,” he said.

“I totally understand it would be very tough being a renter at this stage.

I just think there’s a couple of factors that is like worsening the housing crisis that isn’t caused by renters or landlords.”

As Giddings worked “every different job under the sun”, he had property investment firmly in his sights.

He went to university to do a business degree but dropped out halfway through because he felt it wouldn’t really offer him anything worthwhile.

He kept his head down, worked seven days a week across two jobs and saved up more than $100,000 by the time he was 22.

Giddings felt the time was right to get his first property so he went in halves with his dad.

“My parents aren’t really the kind of investment-savvy people. Like, dad’s a firefighter, mum’s a hairdresser,” he explained to Yahoo Finance.

“We’re kind of very middle class family. And I’ve always been big on investing. So he had the borrowing power because he was working full time and I had the savings.”

But they didn’t look for a property close to them in Victoria, they went for somewhere thousands of kilometres away in Western Australia.

“There’s 15,000 suburbs in Australia, it’s highly unlikely that the area you live in is going to be one of the best performing,” he said.

He bought his first property for $450,000 and then he quickly worked to build up his portfolio. Giddings used more of his savings to get the second home and then used equity from that property to get the third.

He did all this by the time he was just 23 years old.

Giddings said he went down this route after reading dozens of books and listening to countless podcasts about the property market.

After copping a lot of flak from people on social media, the young property investor said it’s easy to point the finger at landlords and blame them for worsening the rental situation.

But he reckons a combination of high migration and lack of construction is really squeezing the market.

“I’m not blaming the people that are actually coming here,” he said. “It’s just the amount that the government is letting in at a time when we already know we’re in a housing crisis.

“It just seems seems strange when we’re in a housing crisis that we would let them in…they’re going to rent so that’s just going to absolutely kill the rental stock even further.

“We’re also building at record lows. We’re building the least amount [of homes] that we have in a decade…that’s why rents going up.”

There have been warnings the government’s plan to build 1.2 million homes in the next 10 years is stalling. In 2023, work commenced on just 163,836 new homes, according to the Australian Bureau of Statistics. That’s 6.4 per cent less on the year prior and the lowest annual reading since 2012.

The construction industry is also facing a tradie shortage, with 90,000 workers needed in the next three months to keep the government’s housing project on track.